All Categories

Featured

Table of Contents

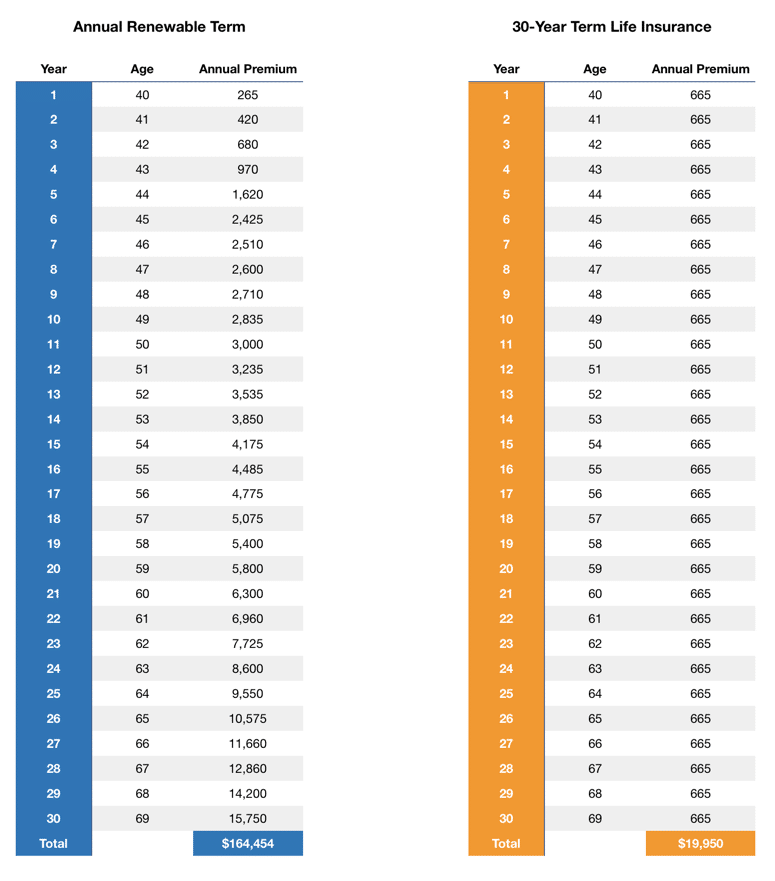

Term policies are also often level-premium, but the overage quantity will continue to be the very same and not grow. The most common terms are 10, 15, 20, and three decades, based upon the demands of the insurance policy holder. Level-premium insurance is a type of life insurance coverage in which costs stay the same rate throughout the term, while the amount of coverage supplied boosts.

For a term policy, this means for the length of the term (e.g. 20 or three decades); and for a long-term policy, till the insured dies. Level-premium policies will generally set you back more up-front than annually-renewing life insurance policy plans with regards to just one year at a time. But over the long term, level-premium payments are typically extra cost-efficient.

They each seek a 30-year term with $1 million in protection. Jen gets an assured level-premium plan at around $42 monthly, with a 30-year horizon, for a total amount of $500 each year. Beth figures she might only need a strategy for three-to-five years or up until complete repayment of her existing financial debts.

So in year 1, she pays $240 annually, 1 and around $500 by year 5. In years two with five, Jen remains to pay $500 per month, and Beth has actually paid approximately simply $357 annually for the very same $1 countless coverage. If Beth no more needs life insurance policy at year 5, she will certainly have saved a great deal of cash relative to what Jen paid.

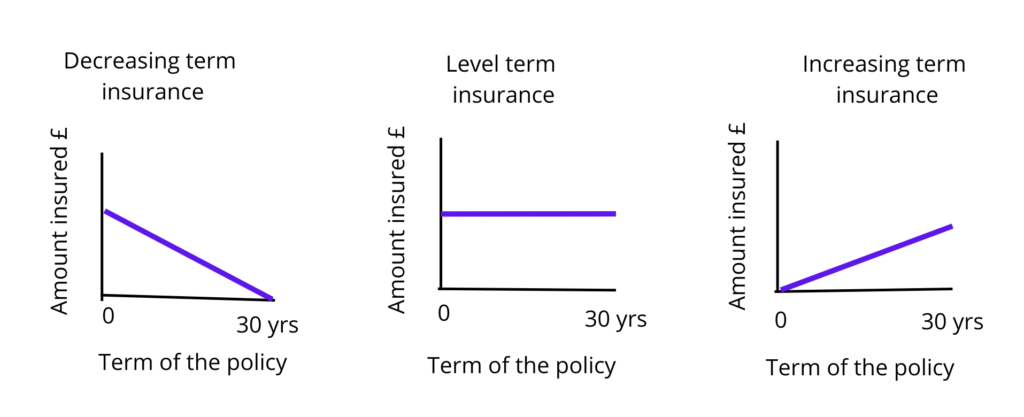

How Does Decreasing Term Life Insurance Compare to Other Policies?

Each year as Beth obtains older, she faces ever-higher annual premiums. At the same time, Jen will remain to pay $500 annually. Life insurance companies are able to provide level-premium policies by essentially "over-charging" for the earlier years of the plan, gathering more than what is required actuarially to cover the danger of the insured passing away during that very early duration.

Permanent life insurance policy establishes cash value that can be borrowed. Policy car loans build up interest and unsettled policy car loans and rate of interest will minimize the survivor benefit and money worth of the plan. The quantity of cash money value readily available will typically rely on the kind of permanent policy purchased, the amount of protection bought, the length of time the policy has been in force and any superior policy financings.

A full statement of coverage is found only in the policy. Insurance plans and/or connected riders and features might not be offered in all states, and plan terms and problems might vary by state.

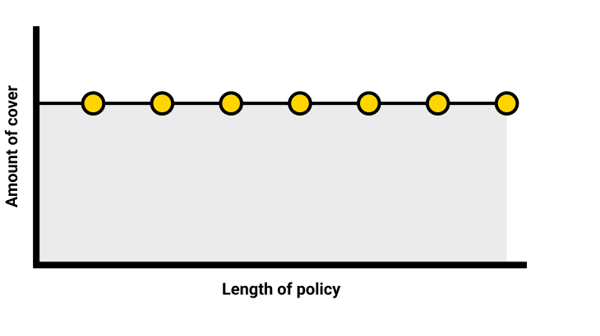

Degree term life insurance policy is one of the most simple method to get life cover. Therefore, it's likewise the most preferred. If the most awful takes place and you pass away, you understand precisely what your loved ones will certainly get. In this article, we'll explain what it is, just how it works and why degree term might be best for you.

How Does Level Term Vs Decreasing Term Life Insurance Work?

Term life insurance policy is a kind of plan that lasts a particular length of time, called the term. You select the size of the policy term when you first obtain your life insurance policy. Maybe 5 years, twenty years or perhaps more. If you pass away during the pre-selected term (and you have actually stayed on par with your costs), your insurance firm will pay a round figure to your nominated recipients.

Choose your term and your amount of cover. Select the policy that's right for you., you understand your premiums will certainly remain the exact same throughout the term of the plan.

Life insurance coverage covers most conditions of death, yet there will be some exemptions in the terms of the plan.

After this, the plan ends and the enduring companion is no longer covered. Individuals usually secure joint policies if they have impressive financial commitments like a home loan, or if they have youngsters. Joint plans are usually more economical than solitary life insurance plans. Other kinds of term life insurance policy are:Reducing term life insurance policy - The quantity of cover reduces over the size of the plan.

What is Term Life Insurance For Couples? Find Out Here

This safeguards the getting power of your cover amount against inflationLife cover is a wonderful point to have due to the fact that it supplies economic protection for your dependents if the most awful happens and you pass away. Your liked ones can also utilize your life insurance policy payout to pay for your funeral. Whatever they choose to do, it's terrific peace of mind for you.

Nevertheless, level term cover is fantastic for meeting daily living expenses such as home costs. You can likewise use your life insurance coverage advantage to cover your interest-only home loan, repayment home mortgage, school charges or any type of other debts or ongoing payments. On the various other hand, there are some disadvantages to level cover, contrasted to other sorts of life plan.

Term life insurance is an inexpensive and uncomplicated option for lots of people. You pay premiums every month and the protection lasts for the term size, which can be 10, 15, 20, 25 or thirty years. term life insurance for seniors. What happens to your premium as you age depends on the type of term life insurance policy protection you buy.

What is Level Premium Term Life Insurance Coverage?

As long as you remain to pay your insurance coverage costs monthly, you'll pay the exact same price throughout the entire term length which, for lots of term policies, is commonly 10, 15, 20, 25 or 30 years. When the term finishes, you can either choose to end your life insurance protection or restore your life insurance policy plan, generally at a higher rate.

For instance, a 35-year-old female in excellent wellness can buy a 30-year, $500,000 Haven Term policy, released by MassMutual beginning at $29.15 monthly. Over the following three decades, while the plan is in place, the price of the coverage will not alter over the term period - Term life insurance with level premiums. Let's face it, the majority of us do not such as for our expenses to grow in time

Your level term price is figured out by a number of factors, the majority of which are connected to your age and wellness. Other elements include your particular term policy, insurance supplier, advantage quantity or payment. During the life insurance coverage application procedure, you'll respond to concerns regarding your health and wellness history, consisting of any kind of pre-existing problems like an important illness.

Table of Contents

Latest Posts

Funeral Insurance Nj

Insurance To Pay For Funeral

Final Expense Insurance

More

Latest Posts

Funeral Insurance Nj

Insurance To Pay For Funeral

Final Expense Insurance