All Categories

Featured

Table of Contents

Life insurance coverage assists make certain that the monetary debt you owe toward your home can be paid if something occurs to you. It makes sense to have a policy in location ensuring that your family will be able to maintain their home no matter what lies ahead.

In some instances, a combination of protection types might provide more benefits than a single product service, far better protecting your home in the occasion that you die unexpectedly. The balance owed on your mortgage would constantly be covered by the combination of one or numerous life insurance policy policies. insurance company mortgage lenders. Using life insurance policy for home mortgage protection can relieve the danger of a person being left with an unmanageable financial burden

Customizing your insurance coverage can provide short-term protection when your home mortgage amount is greatest and lasting defense to cover the whole period of the home mortgage. The combination method can work within your budget, supplies adaptability and can be designed to cover all home loan settlements. There are various methods to make use of life insurance policy to assist cover your mortgage, whether via a mix of plans or a solitary policy customized to your demands.

This policy lasts for the complete term of your home loan (three decades). In case of your passing away, your family can use the survivor benefit to either pay off the mortgage or make continued home loan repayments. You buy an entire life insurance plan to supply long-term insurance coverage that fits your financial situation.

When it comes to protecting your enjoyed ones and making certain the monetary safety and security of your home, understanding mortgage life insurance coverage is important - mortgage insurance and pmi. Mortgage life insurance is a specialized sort of protection designed to repay mortgage financial debts and connected costs in the occasion of the debtor's death. Let's discover the sorts of mortgage life insurance policy offered and the benefits they use

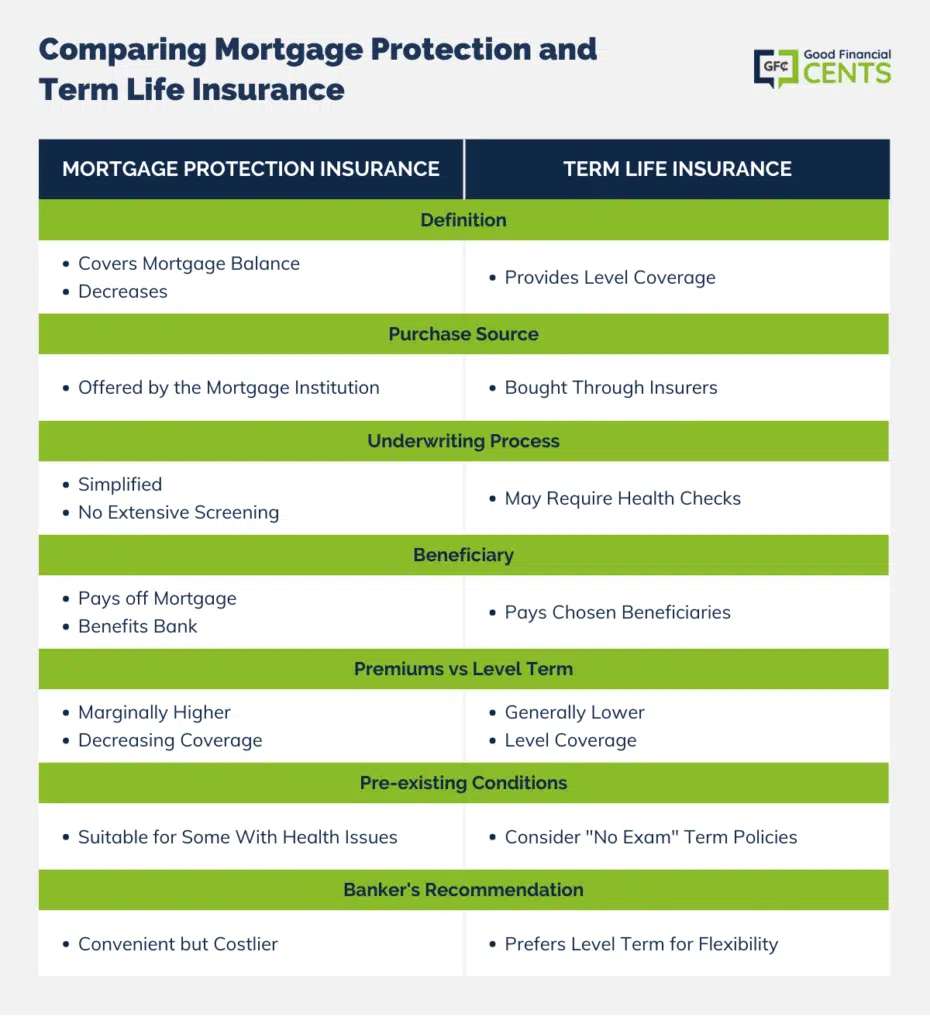

As home loan repayments are made, the fatality benefit reduces to match with the new amortized home mortgage equilibrium exceptional. Decreasing term insurance policy makes certain that the payout straightens with the remaining home loan financial obligation.

Life Insurance Linked To Mortgage

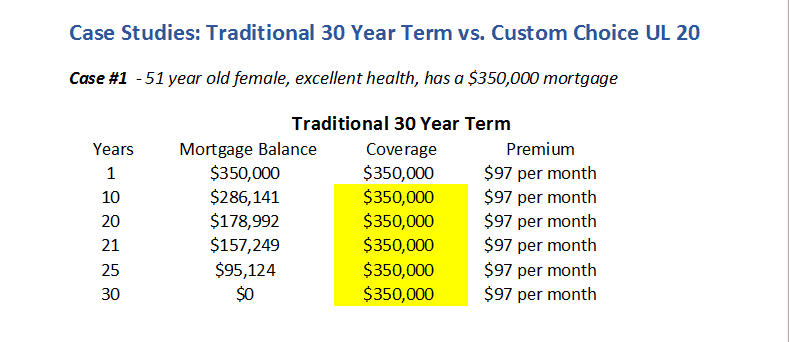

Unlike decreasing term insurance coverage, the size of the policy does not decrease gradually. The policy offers a fixed survivor benefit that stays the exact same throughout the term, regardless of the superior mortgage balance. This sort of insurance policy is well-suited for consumers that have interest-only home mortgages and wish to ensure the complete home mortgage quantity is covered in the occasion of their death.

When it concerns the fate of your home loan after your passing, numerous factors enter play. State and government regulations play a considerable duty in establishing what takes place to your house and the home loan when the owner passes away. The proprietor's actions, such as fundamental estate preparation, can likewise affect the outcome.

These laws determine the procedure and choices available to the beneficiaries and beneficiaries. It is necessary to understand the details laws in your territory to navigate the situation properly. If you have called a beneficiary for your home in your will, that individual usually does not need to take over your home mortgage, supplied they are not co-borrowers or co-signers on the lending.

Mortgage Life Insurance Protection

The decision ultimately relaxes with the heir.It's crucial to think about the financial implications for your successors and recipients. If the thought successor falls short to make home loan repayments, the loan provider maintains the right to foreclose. It might be needed to guarantee that the heir can pay for not only the mortgage payments but additionally the recurring expenses such as real estate tax, homeowners insurance policy, and upkeep.

In most situations, a joint consumer is also a joint owner and will certainly become the single owner of the residential property (mpi life insurance). This suggests they will certainly presume both the ownership and the mortgage obligations. It is necessary to keep in mind that unless someone is a co-signer or a co-borrower on the finance, no person is legally obligated to proceed paying off the home mortgage after the debtor's death

If no person presumes the home loan, the home loan servicer might launch foreclosure procedures. Understanding the state and government laws, the effect on beneficiaries and beneficiaries, and the obligations of co-borrowers is critical when it concerns browsing the complicated globe of home mortgages after the fatality of the customer. Seeking legal guidance and taking into consideration estate preparation options can aid make certain a smoother transition and safeguard the rate of interests of all parties entailed.

Mortgage Protect Canada

In this area, we will check out the topics of inheritance and mortgage transfer, reverse home mortgages after fatality, and the duty of the making it through partner. When it concerns inheriting a home with an outstanding home mortgage, several factors enter into play. If your will names a successor to your home who is not a co-borrower or co-signer on the funding, they typically will not need to take over the home mortgage.

In cases where there is no will or the successor is not called in the will, the duty falls to the executor of the estate. The executor needs to continue making mortgage settlements making use of funds from the estate while the home's fate is being established. If the estate does not have enough funds or properties, it might require to be liquidated to repay the home loan, which can create complications for the heirs.

When one consumer on a joint mortgage dies, the surviving partner normally becomes totally responsible for the home loan. A joint debtor is additionally a joint proprietor, which suggests the surviving spouse becomes the sole owner of the residential property. If the home loan was used for with a co-borrower or co-signer, the various other party is legally bound to continue making car loan settlements.

It is vital for the making it through partner to communicate with the loan provider, recognize their legal rights and responsibilities, and explore readily available alternatives to ensure the smooth extension of the mortgage or make essential setups if required. Comprehending what takes place to a mortgage after the fatality of the homeowner is important for both the heirs and the surviving spouse.

When it comes to protecting your liked ones and making sure the repayment of your home mortgage after your fatality, mortgage defense insurance (MPI) can give important coverage. This kind of insurance is specifically designed to cover exceptional mortgage payments in case of the consumer's death. Let's explore the protection and benefits of mortgage protection insurance coverage, in addition to vital factors to consider for enrollment.

In the occasion of your fatality, the survivor benefit is paid straight to the mortgage lender, guaranteeing that the impressive car loan equilibrium is covered. This enables your family members to continue to be in the home without the added tension of prospective monetary hardship. One of the advantages of mortgage defense insurance is that it can be a choice for people with serious wellness problems who may not qualify for typical term life insurance policy.

Insurance For Mortgage In Case Of Job Loss

Enrolling in home mortgage protection insurance policy requires careful consideration. To get home mortgage protection insurance coverage, normally, you need to sign up within a couple of years of shutting on your home.

By understanding the protection and advantages of home mortgage defense insurance, in addition to meticulously evaluating your options, you can make informed decisions to shield your household's economic well-being even in your absence. When it concerns handling mortgages in Canada after the death of a property owner, there specify regulations and legislations that enter play.

In Canada, if the dead is the sole proprietor of the home, it ends up being a property that the Estate Trustee called in the person's Will should take care of (definition mortgage insurance). The Estate Trustee will certainly need to prepare the home available and use the profits to repay the remaining home mortgage. This is necessary for a discharge of the homeowner's loan agreement to be signed up

Table of Contents

Latest Posts

Funeral Insurance Nj

Insurance To Pay For Funeral

Final Expense Insurance

More

Latest Posts

Funeral Insurance Nj

Insurance To Pay For Funeral

Final Expense Insurance